Another look at SCA Exemptions

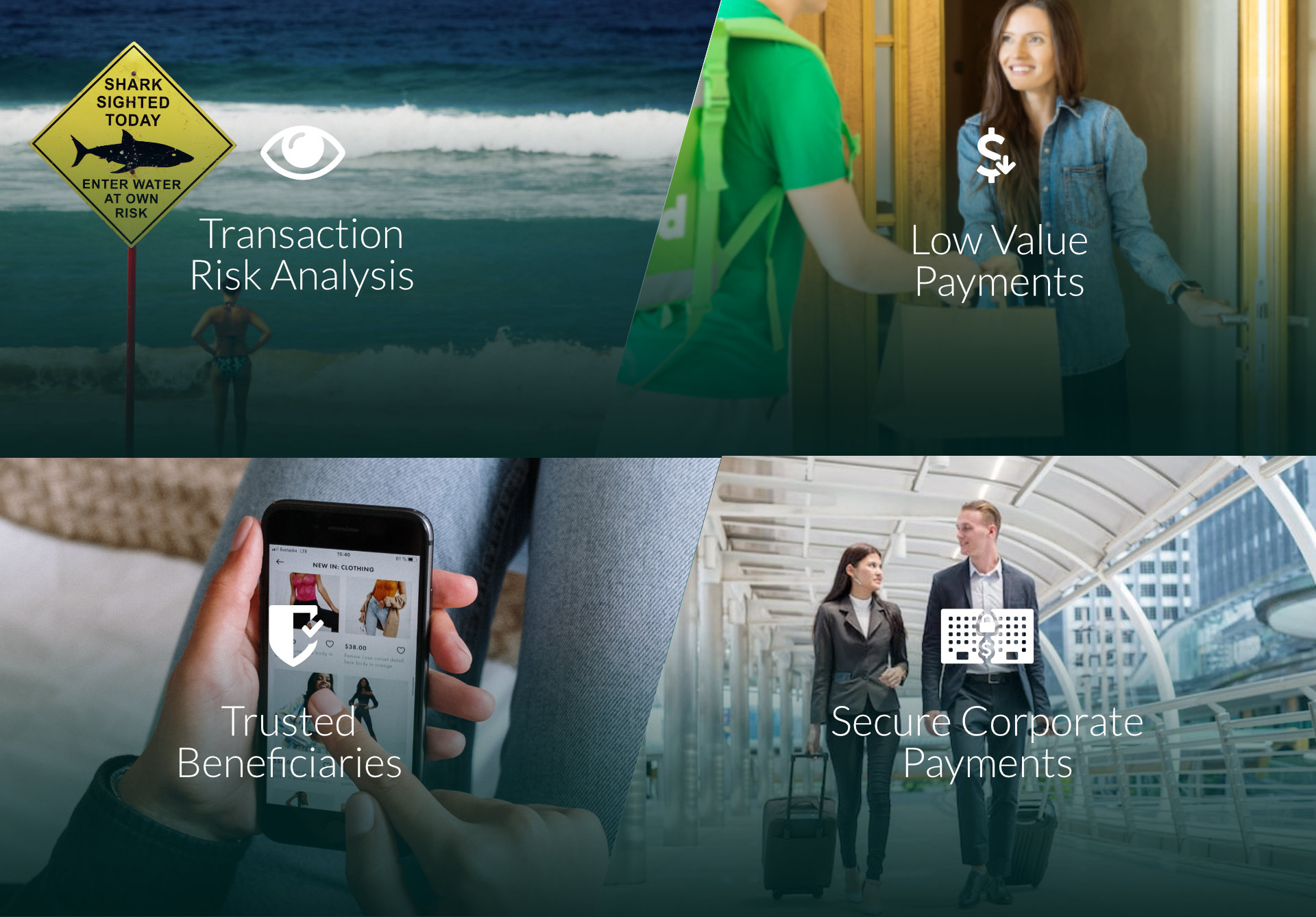

3DSecure 2 introduces four types of transactions for which an SCA Exemption can occur when conditions are met. These are Transaction Risk Analysis (TRA), Low Value Payments, Trusted Beneficiaries and Secure Corporate Payments.

How to use Exemptions

The Low Value Transactions Exemptions is under the control of the Issuer and no action is needed by the merchant.

These exemptions are already available from Version 2.1 and are supported by Message Extensions. Version 2.2 introduces additional support for Trusted Beneficiaries.

Endeavour 3DSecure fully integrates SCA exceptions on its platform and has added extra features to manage and use this functionality effectively.

Transaction Risk Analysis (TRA)

Each transaction is analysed and assigned a risk score. The idea behind the TRA score is simple, if a transaction has a low risk because of the low value and the low fraud rate of the merchant; this forms the basis for exempting the transaction from SCA.

Low Value Payments

These are transactions which have a maximum value of €30. However, there is a cumulative limit of €150 or 5x transactions which are calculated per card and not merchant.

This exemption is controlled solely by the Issuer and is designed to increase friction-less authentication within PSD2 compliance.

Trusted Beneficiaries

This is the same as Merchant White Listing. The cardholder needs to complete at least one SCA challenge and will be given the option to whitelist the merchant; this way a cardholder can build a custom list of trusted merchants which they use often.

The merchant has the option to request merchant whitelisting. However, which Merchants will be offered for whitelisting is solely at the discretion of the Issuer. The merchant is notified that he is whitelisted by the cardholder and can request this exemption in future authentications.

Endeavour supports Merchant White Listing under both versions 2.1 and 2.2.

Secure Corporate Payments

Secure corporate payments are transactions initiated within secure corporate environments such as corporate purchasing or travel management systems on eligible cards; the exemption is automatically applied by the issuer, without merchant request.

Both MasterCard and Visa however provide a mechanism to request Secure Corporate Exemptions via a 3DSecure message which will provide an acknowledgment if the Payment was accepted by the Issuer for the given card and merchant.

Be in the know

Industry news, events and major releases.

Let's talk payments in Amsterdam!

Endeavour 3DSecure - Authentication done right!

Endeavour 3DSecure and Tokenization, your trusted companion in payments.